The Indian stock market has witnessed lakhs of new investors from Tier-2 and Tier-3 cities during the Covid-19 pandemic.

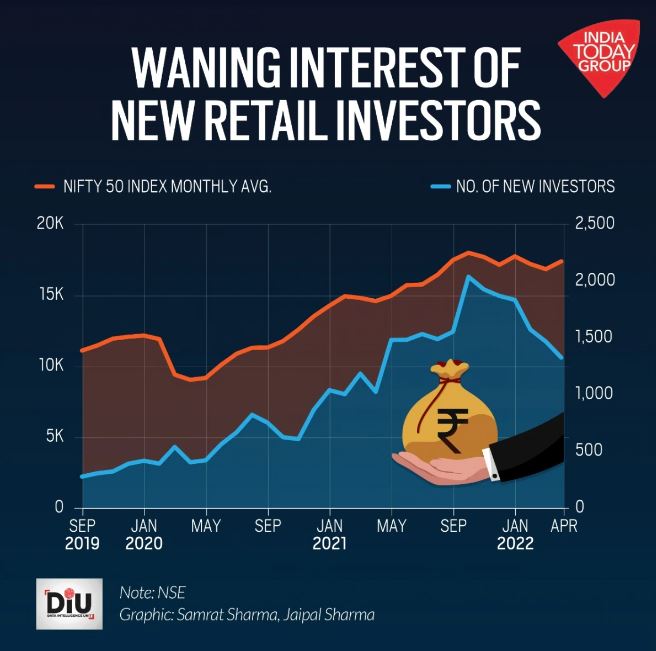

The Indian stock market witnessed lakhs of new investors from Tier-2 and Tier-3 cities during the pandemic. However, this enthusiasm seems to have waned as returns from the market have flattened in recent months. From a high of 20 lakh new investors in October 2021, it has dropped to 13 lakh in April 2022.

At a time when the Covid-19 pandemic and consequent lockdowns affected the economy, the stock market was one of the very few areas where the wheels were still turning. This attracted many new investors, and a record number of new Demat accounts were opened.

The future remained dark with the pandemic looming over us. The global supply chain was crippled. Yet, India’s stock market remained more stable than other markets. Finance Minister Nirmala Sitharaman said that retail investors seemed to act as shock absorbers even when foreign portfolio investors went away.

“New investors rose sharply to a record level as the market was going in one direction. Many IPOs too came during the pandemic that attracted new investors,” Siddhartha Khemka, head of retail research, Motilal Oswal Financial Services, told India Today.

In the last few months, as markets continue to underperform, making a quick buck through share trading has become unviable, Khemka added.

FOREIGN VS DOMESTIC INVESTORS

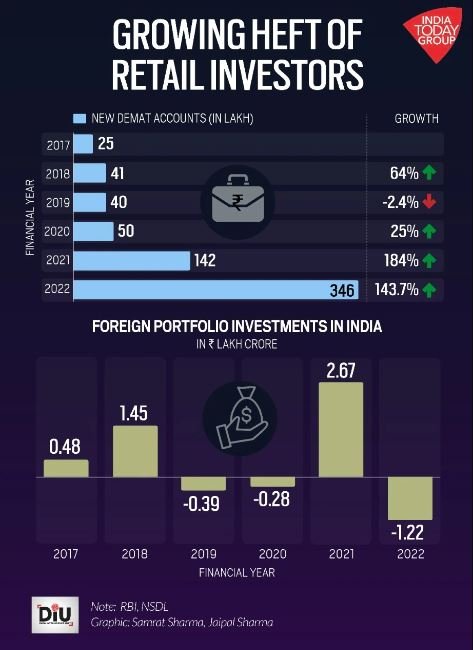

Foreign portfolio investments or FPIs became net sellers for eight out of 12 months in 2021-22 with a net outflow of Rs. 1.3 lakh crore, against a net inflow of Rs. 2.8 lakh crore in the previous year. Mutual funds, on the other hand, made heavy investments worth Rs. 1.7 lakh crore in the Indian equity market in 2021-22, according to the Reserve Bank of India.

There was a massive rise in the number of new Demat accounts. A total of 50 lakh Demat accounts were opened in 2019-20 and 1.42 crore in 2020-21. This shot up to 3.46 crore new Demat accounts in the year 2021-22.

This means that on average, 28.8 lakh Demat accounts were opened every month during 2021-22, which was higher than 11.8 lakh accounts per month in the previous year and 4.2 lakh Demat accounts per month in 2019-20.

WHAT NOW FOR RETAIL INVESTORS?

Experts suggest that ups and downs in the stock market are a usual phenomenon and that new investors should be patient during tough times. For many new investors, the market trend during the 2008 American subprime mortgage crisis is too old to be considered.

“If the retail investors have used prudence and have invested in good stocks with strong fundamentals, they should not worry,” Sethurathnam Ravi, former Chairman, BSE, told India Today. As a word of caution, Ravi added that retail investors should diversify their portfolios and should not take loans to invest in equity.