All financial products come with a statutory warning to read while buying them. For IPOs, the buyer should read the prospectus that discloses the risks associated with the company before deciding to invest.

It is raining IPOs, with over three dozen companies accessing the primary market for raising funds in this financial year.

The interest in IPO has been on account of various factors including growing interest of retail investors, interest rate scenario, low-cost funding, stimulus announced by the United States (US) and European countries resulting in increased liquidity leading to flows from FPIs, etc.

Funds raised by companies belonging to diverse sectors, having negative PE and or net-worth, basis their future business potential, negative or positive profitability. This has also led to a hot debate on the pricing of the IPOs. The recent listing of Paytm, which is below its issue price, has further triggered the question of whether the pricing of IPO should be regulated/controlled or should be based on market discovery.

Companies in favour of the free market do not want any control mechanism to be implemented by SEBI to check the price discovery. A free market is a market that discovers the price.

The other school of thought, being conservative, recommends that SEBI should monitor the valuations of IPO to protect the interest of retail investors and feel that going forward certain criteria such as profit-making concern, dividend-paying, etc must be fixed.

The experts are also of the opinion that the regulator cannot be a post office and merely watch these phenomena of pricing as ultimately it will be the investors will have to pay a price for it.

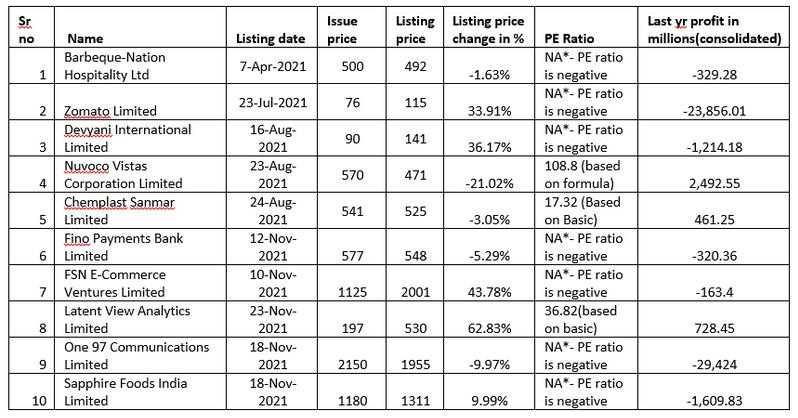

Valuation is not an exact science and it factors various aspects including future profitability, business outlook, brand building apart from the historical financials. As can be observed from the table below, there have been many companies, which despite negative PE and negative profitability have listed on premium or led to the loss of wealth in the hands of the small investors.

Presently, the merchant bankers seem to be making merry out of it as many companies have come out with IPOs and the promoters have gained immensely out of ideas and brand instead of hard financial numbers. SEBI cannot be held responsible for pricing as our markets are liberated and its role is that of policymaking and supervision.

At the end of the day, all financial products come with a statutory warning to read while buying them. For IPOs, the buyer should read the prospectus that discloses the risks associated with the company before deciding to invest.